THE BUDGET BREAKTHROUGH PROGRAM

The budgeting system you can plug into your busy life and stick to, one small victory at a time!

It’s not the fact that you go over budget every month, not really

It’s looking back on December 31 and wondering where it all went — and doubting whether you’ll be any further ahead by the time next year rolls around

It’s seeing your little girl’s face fall when you have to say “no” to her 749th plea for ballet lessons

And the tears you try to hide the first day you drop off your toddler at daycare because you can’t afford to stay at home with him

You work hard and earn a good income, but after you’ve paid the bills, it seems like there’s nothing left for the big dreams you have for your family: Vacation…replacing that outdated bathroom tile…retirement…

Month after month, it all flows right through your fingers as you pay hundreds to Mr. Visa, Ms. Mastercard, and of course his highness Toyota Motor Financing.

And you’re starting to wonder: Will my own kids be able to go to college without a mountain of debt?

In fact, by the end of every month, you’re left wondering why there’s nothing left to stash away for the future.

But here’s the truth: It isn’t your fault

See, most of us were never taught solid financial principles. You get married, have kids, and life just sorta happens.

The thing is, burying your head in the sand will only work for so long…

Until one day you wake up and realize your spending doesn’t match the values you hold important. And worse yet, you don’t even know where your money is going.

What you need is a reboot.

A chance to start again, fresh, with no guilt about where you “should” be in your finances.

You need a system that’s easy to use, easy to keep up with, and will help you map out clear, specific goals, so you can wisely prioritize your spending.

INTRODUCING THE BUDGET BREAKTHROUGH PROGRAM

The budgeting system you can plug into your busy life and stick to, one small victory at a time!

If you feel like you make a decent income, but wonder why you don’t have more to show for it after the bills are paid

If you’ve tried all the apps, read the books, and maybe even done the Dave Ramsey thing, but haven’t made the progress you’d hoped

If you’re tired of feeling lost, without a clear path or focus in your finances

…then the Budget Breakthrough program is for you.

“First, I thought that I would be wasting money because I’ve tried other things so why would this be any different?

However, some of the things you have suggested I catch myself thinking, “well duh! Why didn’t I think of that?”

With your budgeting help, we are set to be completely debt free within a year. When we started this course we were close to $65,000 in debt. We have paid off roughly $30k so far and plan to have the rest paid off by the beginning of the summer!!”

READY TO CREATE A BUDGET YOU CAN STICK TO?

You don’t need a “secret formula” to fix your finances, all you need is to learn to apply a few common-sense principles consistently.

When you join the Budget Breakthrough program, you’ll get the practical step-by-step details of how to budget along with the skills and support you need to consistently stick to it. Inside you’ll find out how to:

CREATE YOUR PERFECT-FIT BUDGET

What you really need to know about budgeting, so that you can finally stick to it every month. (Hint: it has very little to do with being more frugal!)

OVERCOME OVERSPENDING

How the typical approach to budgeting sets you up to fail – and the 5 questions to ask yourself before creating a budget, so you can stay motivated.

STRESS LESS

The counterintuitive first step to budgeting that can free you from money stress right away.

SAVE MORE

How to save money and pay off debt months or even years faster (and yes even have some cash left over for fun, too!)

PREPARE FOR THE UNEXPECTED

The 22 most common unexpected expenses and how to plan for them – so you can relax, knowing you won’t go over budget.

FIND TIME

The 5-step monthly checklist you need so that you can make your spending line up with your real priorities for your money – in just minutes a day.

WHAT’S INSIDE?

A SIMPLE BUDGETING SYSTEM

Inside the program, you’ll get access to my simple system to create and stick to a budget that works in your busy life.

I walk you through 25 lessons, taking you step-by-step through how to put a plan in place for your money, so you can wisely steward what you have.

Each one is short and to the point — designed with busy women in mind. You can view them on mobile, tablet, or computer while you’re waiting for kids to get done with soccer, kicking your feet up after a long day, or whenever you can sneak it in.

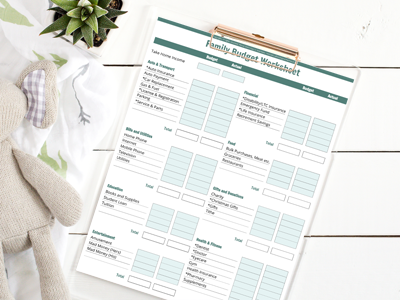

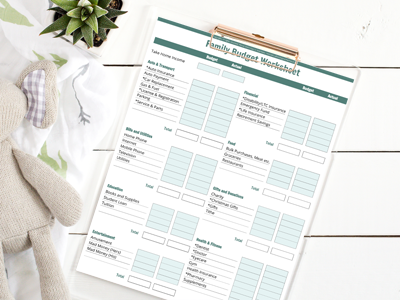

BUDGET ACTION PACK

You get access to more than 21 use-them-now resources so you can put your budget into action and start seeing results right away.

SUPPORT AND ACCOUNTABILITY

Inside the Budget Breakthrough

You’ll have the support of an experienced financial coach who’s been there cheering you on all the way with encouragement and support via email.

“Before joining Budget Breakthrough I was afraid I wouldn’t or couldn’t stick to the plan.

After joining I realized, hands down the difference in Shannon’s program is the personal help she gives.

It’s amazing to be able to spend money confidently now because there is a plan in place. I feel set free.”

GET STARTED NOW

Are you sick of feeling like you’re barely getting ahead when you should be doing better? Now’s your chance to learn a proven system to get on the path to financial freedom. I hope you’ll join us!

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)

BUDGET BREAKTHROUGH PROGRAM

$150

+ 1-year access to the complete step-by-step budgeting course — so you can make a crystal clear plan for your money

+ Get organized with the Budget Action Pack: 21 budget tools and customizable spreadsheets to make budgeting easier

+ Weekly goal check-ins to keep you moving forward

+ BONUS:Get 3 months of one-on-one email support from certified financial coach, Shannon Clark to help you find tailor-made solutions that work in your real life

“Before joining Budget Breakthrough, I was concerned about the cost and the likelihood that it wouldn’t change anything.

However after 12 weeks in the program, I do have some successes. I’ve created my Emergency Fund, paid off my first credit card, am one more month away from paying off the 2nd debt item, and have not incurred any new debt!

It’s an awesome program and I’ve already recommended it to many friends!”

YOU MIGHT BE WONDERING

I’m busy, will I have time for this?

I know you have a lot on your plate, so I’ve broken each lesson into manageable, bite-sized steps. Each lesson takes approximately 30 minutes to complete. After you’ve learned the budgeting system, it’ll take just an average of 5 minutes per day to manage your money.

This is an intensive program for women who truly want to dig in and learn a better way to budget. I’ve made everything as simple as possible, but you need to do the work for the program to work for you.

While I encourage you to keep up with the recommended schedule, you can complete each lesson at your own pace when you have time. When you join, you’ll have access to all the lessons for one year plus the group coaching recordings, so you can refer back to them as much as you need to.

I've tried everything (even the Dave Ramsey program), will this work for me?

I know you’ve probably tried all the apps, read all the books, and maybe even the Dave Ramsey program, but you haven’t made the progress you hoped.

What makes the Budget Breakthrough program different from other systems you might have tried before is the personalized process.

With Budget Breakthrough, you’ll have someone on the outside looking in to give you feedback and help you see areas that could use some attention.

I won’t just run you through the steps of how to budget and leave you hanging. You’ll have ongoing support and accountability via email coaching so you can achieve your goals.

There’s no shame here. Hey, I’ve been there too, and I’ll be there all the way cheering you on to success.

Is this worth the investment?

I know you’re doing your best to steward your family’s resources, and you want to feel completely comfortable with your decision about whether to join the Budget Breakthrough program.

I could tell you about how much my members love this program and how much it’s helping their families. You’ve already had the chance to read many of their experiences of getting on track with paying off debt and saving for the future. (Read more of their stories at the bottom of this page.)

Or you could look at it this way…

A comprehensive one-on-one financial coaching package with me costs $900. The Budget Breakthrough leads you through the same process and provides ongoing support and accountability, without the premium price tag.

The thing is, every minute you wait around to decide is another minute you stay stuck, stressing about your finances, and not living the life you dream of for your family.

You’ve got too much going on to sit around agonizing about whether to join. Jump into the program and let’s start getting results.

Is my payment information safe with you?

All of your payment info goes through the reputable third-party payment processor Stripe (the same one used when you check out at Target.com and over 100,000 other online businesses), so you don’t have to worry. I never see your payment info and it is not stored on my site.

When will I be billed?

Your card will be charged once for the full cost of the program on the day you register. This is not a subscription, and you won’t be billed for any future payments.

What if I still have questions?

Still have questions? Please don’t hesitate to ask. Email me at [email protected].

HERE’S WHAT BUDGET BREAKTHROUGH MEMBERS ARE SAYING…

SHANNON CLARK, FINANCIAL COACH

I know what it’s like to fail at budgeting.

As a new mom, I had big dreams for my family: our dream home, family vacations, healthy meals on the table. But every month I saw those dreams slip away as we went over budget again. Finally, we hit rock bottom, losing our home in a short sale.

After years of frustration, I slowly learned how to make budgeting easier.

By the grace of God, we paid off $22,047 in 9 months to become debt free, and that was just the beginning. Next, we built an emergency fund, and a huge down payment for our dream home.

In a few short years, we’ve experienced a dramatic turnaround in our budget, but the best part is that we’re finally seeing our big dreams for our family come true without constantly stressing about money.

If only I had known how quickly we could turn around our finances with simple changes to the way we budgeted!

And that’s why I created the Budget Breakthrough program. There’s no way I can let other women waste years struggling to budget, only to see your dreams slipping away — there is a better way.

I’ve now had the opportunity to teach over 5,822 women through my budgeting courses and coaching. You can dramatically transform your finances too, and I would love to show you how!

“In the 3 months that we have been following the Budget Breakthrough program we have paid off that last $10k in credit card debt.”

“My husband lost his job due to layoffs in 2010, we lost our home and he went on an independent business venture that went south, we now had quite a bit of debt and we had no idea what we had been buying, so in 2014 we paid for and attended a Dave Ramsey Financial Freedom course. This was helpful in getting my husband and I on the same page but not in getting us working on a system to make budgeting a lifestyle, no matter what we did we always had $10K in credit card debt to pay off.

I remember when I signed up for the Budget Breakthrough program, I worried that I wouldn’t be able to commit…

…that I would start strong but burn out within a few weeks and just shrug it off, after all, what we were doing was “working”, right?

In the 3 months that we have been following the Budget Breakthrough program we have:

1. paid off that last $10k in credit card debt

2. we now sit down together as a couple and bi-monthly plan where our money is going to go

3. go shopping with cash and a plan, not cards and a general idea.

4. we are working on quarterly budgeting summits where we sit down and look over everything and make new goals for moving forward

5. mapped out a savings/debt payment plan

6. any expenses that have to be put on CC are placed in the budget and paid off within a week of making the purchase

Shannon has a style of teaching that speaks to me with dignity, I wasn’t some dummy for getting myself in debt and now needed a reprimand to get me out. Not only does she have the wisdom to get you out of the hole but she has the compassion to express through her lessons, “I’m right there with you”. I think that is what made the biggest difference for me, she makes this process a personal one.

I felt like she was there cheering me on and it made me want to at least try what she was suggesting, and you know what, her suggestions are so simple and yet so effective!”

GET STARTED NOW

Are you sick of feeling like you’re barely getting ahead when you should be doing better? Now’s your chance to learn a proven system to get on the path to financial freedom. I hope you’ll join us!

We’ll kick off the program on Tuesday, January 18, so hurry. Registration closes at 8 pm Pacific on Friday, January 14th.

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)

BUDGET BREAKTHROUGH PROGRAM

$150

+ 1-year access to the complete step-by-step budgeting course — so you can make a crystal clear plan for your money

+ Get organized with the Budget Action Pack: 21 budget tools and customizable spreadsheets to make budgeting easier

+ BONUS: Get 3 months of one-on-one email support from certified financial coach, Shannon Clark to help you find tailor-made solutions that work in your real life

MEET THE BUDGET BREAKTHROUGH GRADS…

“Definitely worth the money spent on the course even if I was hesitant to put the money into it at the beginning!”

“Before I tracked some spending and used a spreadsheet for our budget. I also tried to track spending in the GoodBudget app/website. We would use some of our tax return to pay extra toward our credit card, but there wasn’t any real plan for savings other than wanting to save.

We weren’t in dire straits, but I was ready to not feel like we are barely getting ahead when I knew, by the numbers that we should be able to do better, save more, spend less, etc.

I was concerned about registering for Budget Breakthrough because of the cost of the course.

But I realized that I sometimes need to invest in things to see progress.

Since joining the program, we have increased our net assets by $13,000 and put $6,000 in savings.

We put over $1,000 in savings in the month of March alone! This is so huge because even 6 months ago, I would have said that we barely had $100 to put into savings in a month!

We now know how to track our money and having a specific goal for the extra helps motivate me to keep working at it!

The breakdown of steps in tracking everything helped as well as setting specific savings goals.

While I sometimes chafed at the slower pace of having only a module a week, I think it helped keep my momentum going longer so it was stronger and kept me motivated through the first month especially.

I’m enjoying the spreadsheets that have built-in organizing for our finances.

I love knowing where our money is going and where we want it to go.

Having a plan for where our money goes and seeing where we can be in the near future has motivated me to look for more opportunities to earn money while I’m home with my kids.

Thank you for all of your time and teaching.

Going forward, we plan to:

- Pay cash for a new-to-us car next winter or spring.

- Go on vacation in June with the money already in place for the trip.

- Plan for and pay cash for a cruise in the next year or two.

- We are currently on track to pay off our house in less than 6 years. We would love to shorten that time even more.

Definitely worth the money spent on the course even if I was hesitant to put the money into it at the beginning!”

“This truly took me from feeling hopeless, guilty and unable to stick to my budget – to LOVING a budget!!”

We tried Dave Ramsey to figure out budgeting and how to save money. We ALWAYS felt like we lived paycheck to paycheck even though our home was our only debt. We were very discouraged. It was so tiring to try and figure out ways to cut back and still fail. We felt like we could never do anything or buy anything.

Before joining Budget Breakthrough I was hesitant to try it, being afraid I wouldn’t or couldn’t stick to the plan, or it wouldn’t really help anyway.

Since becoming a part of the Budget Breakthrough program:

- I have colored 2 bars on my Goal tracker for the 6-month emergency fund which I am really excited about. I’m a visual person and seeing progress helps. Also, when I am coloring those bars in, there is no way I am going to take money out of that goal to use for something else. :)

- I have also really begun to understand how to save for those sinking fund items and re-adjust my budget each month (as well as mid-way through).

- I have a routine for the monthly, weekly, daily budget things. I love the print-out Shannon provides that helps me hit each of those.

- I have focus now. Before I felt scattered… I would easily change my mind about what a certain amount of money was for and I would have a million things I wanted to do with our tax refund. It’s so refreshing to have a goal. Somehow the way Shannon has you set goals and work towards them really keeps my focus.

Hands down, the difference in Shannon’s program is the amount of detail in the lessons and the personal help she gives.

In doing this course, I realized the reason the other system didn’t work for me. It did not have a full plan laid out. There was so much I didn’t know. I could put money in envelopes and stop spending in that category when the money was gone, but what would I do if we had something come up and really needed more groceries? Shannon to the rescue :)

This truly took me from feeling hopeless, guilty and unable to stick to my budget to LOVING a budget!!

I began looking forward to seeing where I could find the money or make the money if my categories were starting to approach their limit.

I looked forward to all of the lessons. They are so well thought out and so thorough, you can follow step by step and succeed!

It has been a great experience. I feel like I’m getting somewhere now!! I am getting somewhere now!

The sinking fund has given my husband peace of mind because he knows one day our water heater is going to break down and we are accounting for it. Having a plan for those expenses is huge!

It’s amazing to be able to spend money confidently because there is a plan in place. This confidence has replaced guilt! I literally felt guilty every trip to the grocery store before this.

I feel set free.

Thank you, Thank you, Thank you, Shannon!!!!”

“Since joining Budget Breakthrough, I’ve gained a connection back to my finances.”

“I was on the third baby step in the Dave Ramsey program but felt like I’d totally lost motivation and accountability. I’m single momming it with two teens and was cringing about college on the horizon.

I’m a total nerd and have always liked saving. In fact, my older brother would borrow money from me…and I’d charge 1 or more pennies per day of interest :) However, there’s a real wobbly space after you pay off your debt where you feel like it’s time to party, party, party. And I didn’t want to lose momentum or excitement even though one part is done.

I was hesitant to sign up for the Budget Breakthrough program because of the time commitment…

…but I loved reading Shannon’s newsletters and knew there is wisdom and joy in learning from her.

Since joining Budget Breakthrough, I’ve gained a connection back to my finances. I had no debt but was feeling kinda fuzzy about my next goal and how to reach it. I also wanted to learn how to do a sinking fund as I think that’s an essential part to keeping things running smoothly budget-wise over time.

I like learning new things and I’ve LOVED the program!

The weekly things to do over the course of Budget Breakthrough really helped solidify the practices for me.

I didn’t feel overwhelmed and I didn’t feel like I was expected to jump so soon after learning things.

The pacing and length was perfect!

It’s quick and helpful information that is really making a positive impact on my finances!!

I totally love my videos from Shannon that answer any questions from my feedback form. They make me feel so special.

I also love the worksheets and all the many ways you can access them. My favorite is making ones on my Gmail Drive :) So easy and the samples to look at are very helpful. I really think the program is genius.

For me, I’ll be working on finishing up my one-month emergency fund, and fully funding a week at the beach in June. After that, I’ll be working on adding 4 months to my second emergency fund and maybe planning a short Fall vacation that is fully funded.

This has been such an amazing experience and it has inspired me in more ways than one! I’m hoping to slowly grow a side-business over the next year or two and figure out with my oldest teen things about college.

Thank you, thank you, thank you, Shannon, for your wisdom, expertise, and support!”

“I feel as though I can enjoy my time with my children more because we have a plan for our future.”

“The majority of my efforts prior to this course came from trying to not spend money, but we also tracked the majority of our expenses (what we had spent that month) on a spreadsheet.

The problem was, there was no roadmap or goals associated with this tracking so I wasn’t motivated to stick to the amounts we had set for each category.

Since becoming a part of the Budget Breakthrough program, the most important result for me was setting goals for our family finances, and then mapping out how we were specifically going to do that, including both long-term and short-term goals.

I no longer feel overwhelmed.

With a specific plan, we have been able to pay off over $5,000 in debt!

We paid off one of our car loans, so now we only have one car loan to pay. We also paid off medical bills we had from having a high deductible insurance plan.

In addition, I now have a routine that helps me to stay on top of our finances. I have a morning routine to keep up with daily expenses, and have calendar reminders of when to update budget forms. Having all of this in the forefront of my mind has empowered me to make decisions about spending and to make our financial decisions much more clear and manageable.

Rather than making purchases despite going over set category amounts, now I wait to make purchases if it would put us over for that month. This discipline is derived from being motivated to go after our goals, rather than make an impulsive purchase.

This course has changed my relationship with money and has helped me buck the societal pressures of how to spend money.

The biggest difference about the Budget Breakthrough program was the personal accountability.

And I can’t say enough how motivating Shannon’s support and encouragement of me as an individual was, and how her tools and guidance have made this process manageable.

Our present goal is to eliminate all debt other than our mortgage payments (which start in June!). We are off to a good start with this and just need to keep being diligent about putting extra income towards our debt.

I am so appreciative for this course.

It has alleviated the stress I felt about not doing enough as a stay at home mom and has completely changed our life.

It has revealed what is truly necessary and what can be put on the back burner in our efforts to meet our goals.

Even though our income hasn’t changed much since we started the course, I feel as though I can enjoy my time with my children more because we have a plan for our future.”

“It’s nice to know I’m not the only one who struggles with keeping a budget.”

“When I first started staying home with my son, I felt the only way I could justify it was by keeping a tight budget. I tried creating spreadsheets, pulling out cash for specific categories, and even took a budgeting class at my church. It wasn’t until the budgeting class that my husband and I really got on the same page, but we still lacked the tools to successfully budget.

After passing Budget Breakthrough up before, I knew I had to do it this year, and God literally provided the funds a week before I signed up!

I’ve always had the desire to budget and be a good steward of what we have been given, but it wasn’t until I got the tools from the Budget Breakthrough program that I really started to be successful.

It felt SO good to fund our Emergency Fund. Now it’s time to get going on our debt snowball! I’m excited!

The lessons were straight forward, the spreadsheets are easy to use (even for someone who is not good with spreadsheets), and the system is realistic for a busy mom!

The heart and the calling Shannon has for this program shines through. I had a unique circumstance with my debt snowball calculator, and she worked with me and helped me extensively with that form to make it work for my situation. I’m excited to use it now, all because she went above and beyond to help me make it work!

It’s nice to know I’m not the only one who struggles with keeping a budget. It’s often taboo to discuss finances, so it’s nice to have a forum where it’s good to discuss the challenges.

The accountability is great! Knowing I’m not alone in the budgeting battle helps me to push forward to win the war!”

“Before Budget Breakthrough I would google things about budgets, look for apps – it was all kind of quick fixes to just instantly know what to do, and then would just let it all slide. I would bounce from telling my husband we can’t spend any money to thinking “we’re fine” and then wildly overspending and starting the cycle all over again. It all felt very out of control and like something I would never be able to tackle realistically.

Now, I actually have a handle on our budget, our expenses, and how to plan for them.

At first I found the slow pace of the lessons frustrating but honestly, it made it all break down into super manageable steps. Also having the concrete advice both about how to handle things, how to use Mint properly and the schedule is genius!!

I am so grateful!

I can’t even tell you what a relief it is to finally feel like I have a handle on all this, and not dread it all.

And because I don’t dread it, the tracking every day is a breeze and makes such a big difference.

My husband is on board and sees this isn’t even that hard or about making giant sacrifices. Also, I realized I had totally got our braces goal wrong, so we have even more money in our budget! And underspent in March – hurrah!

I loved this course – it truly gave me a different outlook, the tools I need and answered a lot of questions for me.”

WHERE WILL YOU BE 90 DAYS FROM NOW?

Three months from now, you’ll either be celebrating your latest budget victory — or you’ll still feel lost, stuck in the same old struggles you’ve been battling for years. Which one will you choose?